Notes on John Maynard Keynes as an Investor

By David L. Steinberg

A compilation of insights and observations on John Maynard Keynes' investment philosophy, drawn from his writings, letters, and the historical record of his remarkable career as both economist and investor.

## I. COMPOUND INTEREST AND THE INDUSTRIAL MACHINE

According to Keynes, well-managed industrial companies do not, as a rule, distribute to the shareholders the whole of their earned profits. In good years, if not in all years, they retain a part of their profits and put them back into the business. Thus, there is an element of compound interest operating in favor of a sound industrial environment. Over a period of years, the real value of the property of a sound industrial company is increasing at compound interest quite apart from the dividends paid out to the shareholder. Thus, an index of shares yields more in the long run than its initial apparent rate of interest.

## II. MARKETS, SPECULATION, AND CROWD PSYCHOLOGY

There is considerable evidence that supports some kind of invisible hand as defined by Adam Smith—what some call "the intelligent multitude." The idea that a group of decision makers can be greater than the sum of its parts. This is now prosaic in terms of the efficient market hypothesis, but an outright rejection of this concept is unsound, just as full acceptance of it is unsound. We operate on a spectrum of information and scenarios. While we depend on some degree of this intelligent multitude, there are also rampant aspects of inefficiency. As a Chinese proverb puts it: "One dog barks at something, and a hundred bark at the bark."

### The Speculator's Mindset

Keynes described the speculator as an investor who is largely concerned not with making superior long-term forecasts of the probable yield of an investment over its whole life, but with foreseeing changes in the conventional basis of valuation a short term ahead of the general public.

### The Beauty Contest

Keynes wrote about newspaper competitions where competitors must pick faces they think others will find prettiest, rather than those they themselves prefer—a metaphor for market speculation where investors try to anticipate what average opinion expects average opinion to be.

## III. THE 1929 CRASH AND KEYNES' TRANSFORMATION

Following the Great Crash, Keynes completely inverted his investment principles. He essentially became an investor rather than a speculator—one who focuses on likely future performance rather than past trends, expected yield rather than price, particular stocks rather than the broader index, and relying on his own judgment rather than that of the market.

## IV. VALUE INVESTING

Keynes wrote about the long-term investor who promotes the public interest but will come in for most criticism, for it is in the essence of his behavior that he should be eccentric, unconventional, and rash in the eyes of average opinion.

## V. CONCENTRATION VS. DIVERSIFICATION

When Keynes owned a large percentage of the portfolio in one company, he noted his "chronic delusion that one good share is safer than ten bad ones." He recognized that diversification is a protection against ignorance, but also a tax for ignorance in the sense that it will ensure an average performance.

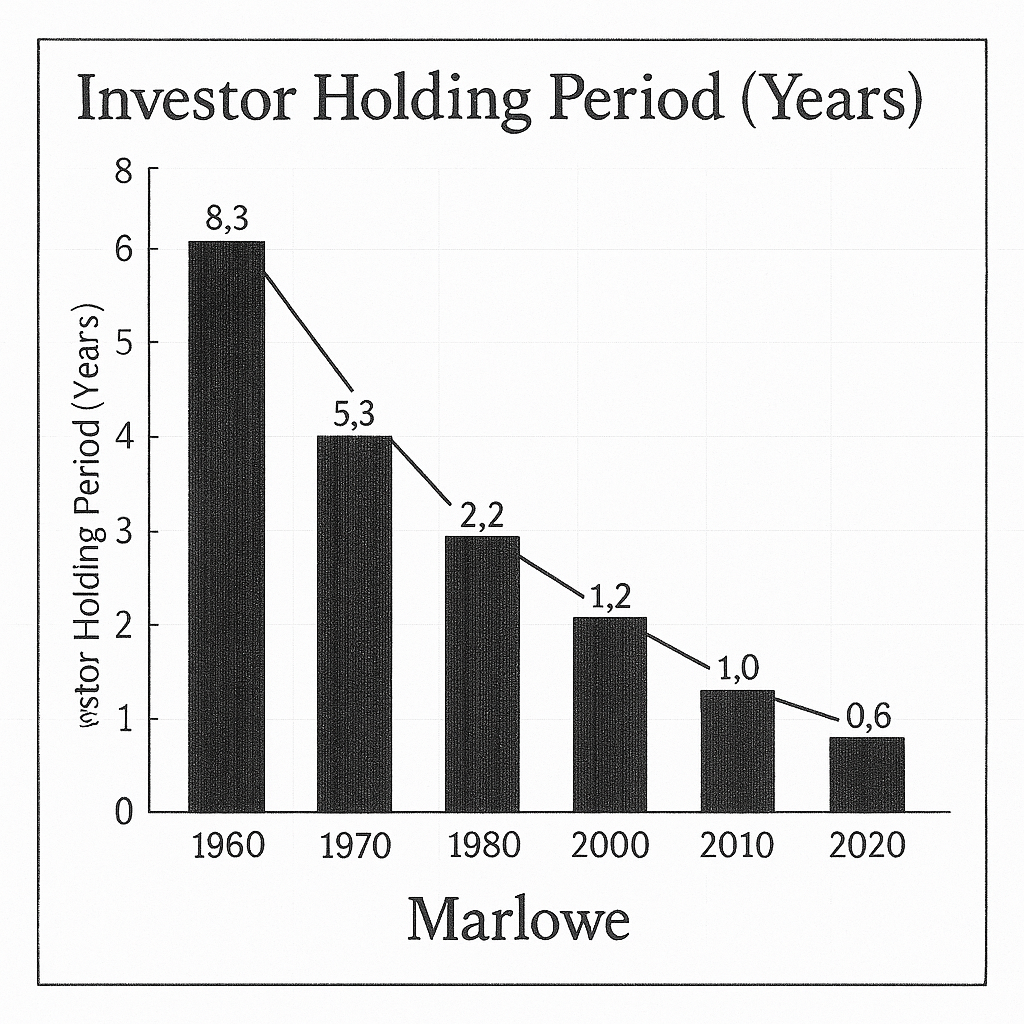

## VI. HOLDING PERIOD AND MARRIAGE

Keynes believed that successful investment depends on a steadfast holding of fairly large units through thick and thin, perhaps for many years. He suggested making investments "permanent and indissoluble, like marriage."

## VII. KEYNES' TRACK RECORD

The Chest Fund recorded a roughly tenfold increase in value in the 15 years to 1945, compared with essentially a flat return for the S&P 500 average and a doubling of the London Industrial Index at the same period of time.

Written by David L. Steinberg

© 2025 David L. Steinberg. All Rights Reserved.