Volatility: A Misunderstood Friend

By David L. Steinberg

The conventional question in portfolio management is straightforward: doesn't diversification reduce volatility? The more pressing question is: how much, and at what cost?

Volatility reduction is not our goal. But even if it were, the marginal benefit of expanding from, say, twenty companies to thirty—or thirty to one hundred—is surprisingly limited. Beyond a certain threshold, diversification dilutes signal into noise. It becomes the financial equivalent of averaging everything together until you're left with a bland consensus. Nobody's an expert. Nobody knows anything.

## The Orchestra Metaphor

Consider an orchestra where every musician plays the exact same note at the exact same volume, simultaneously. Or a band where each member sings and plays their instrument at identical levels, at identical times. What happens? The music—which in this case is a metaphor for performance—gets muted into complete mediocrity.

What's remarkable is that you can capture most of the smoothness by simply reducing diversification from one hundred holdings to perhaps twenty or twenty-five. Yet few people do this.

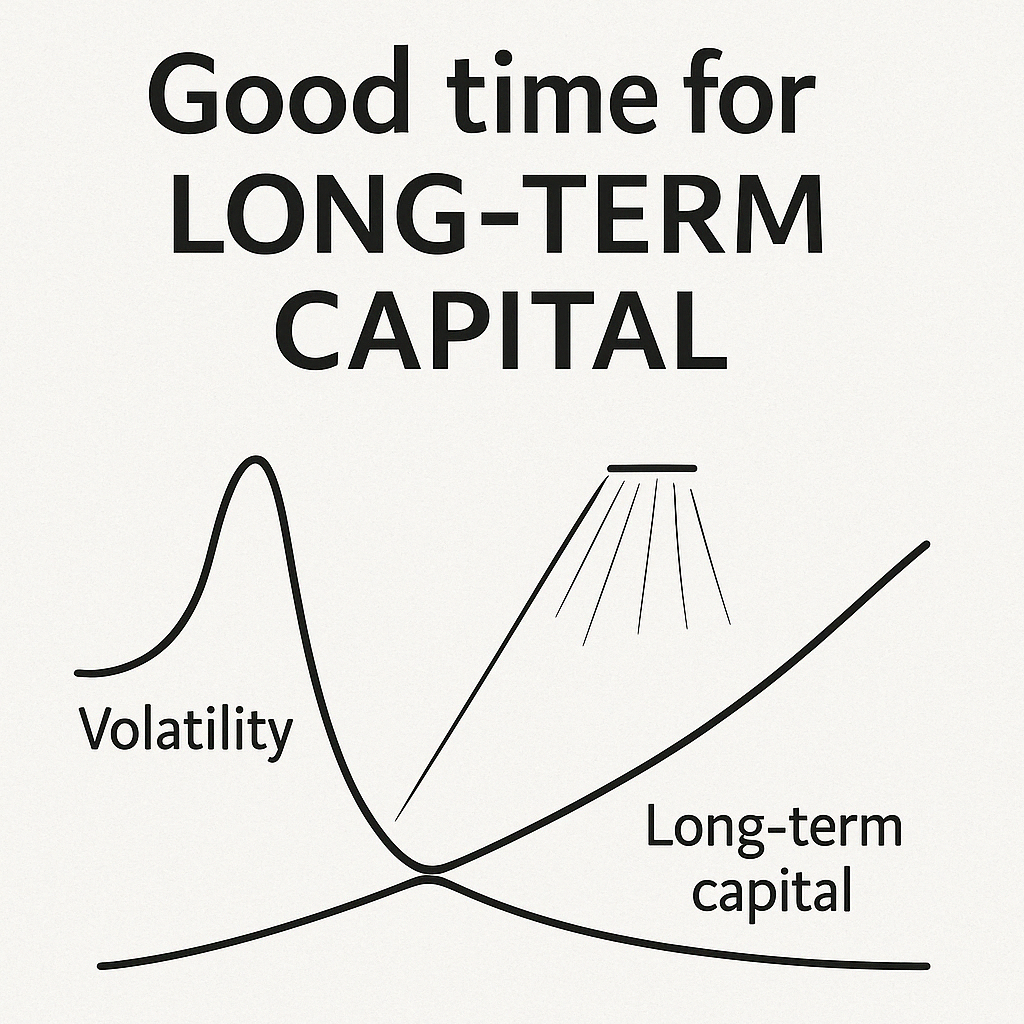

## Volatility Is the Tell

Volatility is not the enemy. **Volatility is the tell**. It's the revelation. It's what reveals mispricing, forces clarity, and rewards patience. The presence of movement is what gives our process its advantage. Without volatility, there's no opportunity to harvest. And we want to harvest and accumulate capital aggressively.

Like most valuable things, there is a cost. The cost is psychological comfort with volatility, and a business designed specifically for this reality. It means owning a portfolio built not for asset accumulation, but for outcomes. It means understanding that temporary discomfort is not a flaw—for us, that discomfort is literally the system.

## Concentration as Risk Reduction

Strategies like ours are uncommon for precisely these reasons. They're uncomplicated, but rare, because they require discipline to execute and the conviction to say: **I am an expert. I know this.** And we don't simply state that conviction in lengthy letters—we represent it through position sizing. Once you understand a business deeply, concentration becomes a way to radically reduce portfolio risk, not increase it.

This requires a different mandate and a different mindset. We don't think in terms of so-called exposures. We think in terms of ownership.

To us, volatility is a wonderful thing. It reveals opportunities. But for an allocator, I would suggest it reveals who the manager really is. Because the only antidote to volatility is conviction—which comes from being intimately familiar with the case.

Written by David L. Steinberg

© 2025 David L. Steinberg. All Rights Reserved.